Today, the Big Innovation Centre is launching an overview ever produced of the UK AI Industry. The analysis and report entitled “AI Industry in the UK Landscape Overview: Companies, Investors, Influencers and Trends” are products of the company’s Innovation Eye IT Platform and powered by Big Innovation Centre and Deep Knowledge Analytics.

It is a new 2021 version of their 2018 analysis and report which was originally published in dialogue with the All-Party Parliamentary Group on Artificial Intelligence (APPG AI) which contained the first comprehensive mapping of the UK AI landscape.

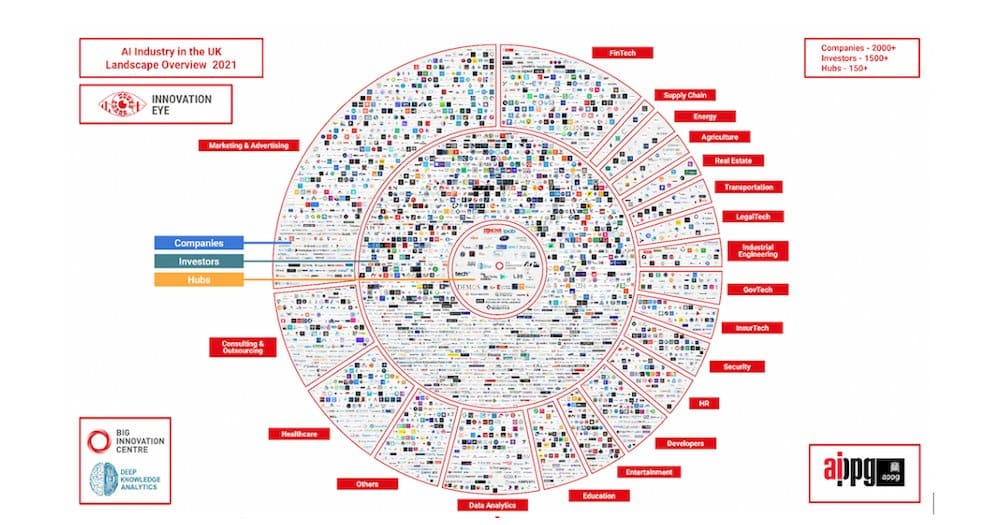

The Big Innovation Centre show the rapid pace of which the UKs’ AI industry is developing, by analysing more than 2000 AI-centric companies and 1500 investors who invested £13 billion into the UK’s AI sector, and more than 90 hubs with AI programmes (including think tanks, tech-hubs, doctoral training centres, and events companies).

The report also identifies more than 150 influencers and experts in the AI space (divided into specific areas of practical application, including Policy, Business, Academia, and Think Tanks).

Their main findings are:

UK’s AI Funding Landscape:

- The total funding to the UK’s AI industry to date is £13.8bn. Funding to the AI sector generally began around 2010. The total growth in the funding to the UK’s AI industry over the past 3 years [2019-2021] is £9bn.

- The total number of investors in UK’s AI investors who have provided this funding now exceeds 1500 investors, and the total growth in the number of investors in the AI industry over the past 3 years [2019-2021] is about 900.

- The top 3 AI sectors which have received AI funding are Fintech, Marketing & Advertising and Health (got ca 60% of total AI funding), and the top 15 UK AI companies by Total Funding got ca 26% of this funding provided over the past 3 years [2019-2021]

* Funding includes investments, donations, grants and subsidies.

UK’s AI Industry Demographics:

- The total number of AI companies (start-ups and scaleups) in the UK now exceeds 2000, which is double that of three years ago, so we have experienced a growth of ca 1000 AI companies over the past 3 years [2019-2021].

- 65% of UK’s AI start-ups and scale-up companies are headquartered in London.

- The top 3 AI sectors by number of companies are Marketing & Advertising, FinTech, and Consulting (constitute ca 47% of Total AI companies).

The 90-page report and online analytics is described in text, data, graphics, and interactive online mind maps containing hundreds of websites which breaks down investment on a company-by-company basis more than £13 billion worth of investment into UK AI companies and maps the company’s entire AI ecosystem (companies, investors, influencers, and trends).

Professor Birgitte Andersen, CEO Big Innovation Centre said: “As of today, we can identify £9bn more investment into UK AI entrepreneurship and innovation since our analysis 3 years ago in 2018, with the with the largest sectors (by funding) being FinTech, followed closely by Healthcare, and Marketing and Advertisement.

“We see how the UK and in particular London is becoming a true innovation and investment epicentre for everything AI. Almost 1300 (or 65%) out of the UK’s 2000 AI start-up and scaleups companies are headquartered in London. One could conclude that the entrepreneurial AI community is located close to the finance, marketing and policy bodies that are needed to grow the UK’s AI industry.”

Dmitry Kaminskiy, CEO Deep Knowledge Group, said: “London is home to 1300 AI companies, comprising 65% of the entire UK AI industry ecosystem, but it is notable that 700 other AI companies are distributed across the UK more broadly (constituting 35% of the UK AI landscape), making London the most densely populated AI Hub in the entire European continent, and the UK a veritable AI nation. As the country continues to support the growth of its AI Industry Ecosystem in a more direct and explicit manner, we can expect the UK’s already-formidable international leadership position to only grow stronger and more evident in the coming years.”

Lord Clement-Jones CBE, said: “The UK’s AI industry can’t succeed without political support and regulatory certainty, so I am delighted to see evidence in this report that investment and uptake of AI technology and integration is now happening in cooperation with regulators and policy bodies which are playing a pivotal and positive role to help promote dialogue with industry, stakeholders and citizens to shape the AI technologies to become ethical and purposeful.”

Stephen Metcalfe MP, said: “I welcome this landscape report of the UK AI industry, which breaks down on a company-by-company basis more than £13 billion worth of investment into UK AI companies. We now have an opportunity to use every tool of our new AI technologies to develop, deploy and use them for the public, common, enterprise, economic, and social good. The detailed results described in the report must be considered by the politicians and the AI office of the government leading the AI strategy.”

Scott Steedman CBE, Director-General, Standards, said: “There is an urgent need to coordinate our efforts across the AI community to agree standards and best practices. This report helps to identify the entire AI ecosystem of entrepreneurship, investors, business and policy leaders, regulators and developers. Mapping the dialogue and the discussion will enable us to promote UK leadership in AI technology and governance through new standards and purpose.”

Professor Stuart Russell – British computer scientist and founder of the Centre for Human-Compatible Artificial Intelligence, UC Berkeley “This report confirms that Britain is a powerhouse of ideas and innovation in AI, well supported by government and the financial sector. To realize the potentially enormous economic and social benefits of AI in the future, we will also need technological and regulatory measures to ensure that AI remains safe and beneficial, and I am pleased to see that Britain leads in this kind of thinking.”

The Big Innovation Centre concluded that the UK has a virtuous circle of growth in AI development, Investment, deployment, and adoption.

NEW FINANCE: The investment confidence in UK and London is high and growing, and UK’s AI innovation and investment ecosystem is becoming a magnet for entrepreneurial finance. Also, UK’s high-tech AI fintech companies are in its own financial centre of London that are needed to grow it.

NEW BUSINESS BRANDS: Furthermore, London – being Europe’s marketing and advertisement hub is now also innovating new AI marketing and advertising businesses for AI development, deployment, and adoption.

MORE TALENT: The UK has a highly integrated AI innovation ecosystem of talent including the AI science base, the technological foundation, and a tradition of digital entrepreneurship. Those industry, finance and talent systems are mixed with a talent-enabling network of AI think-tanks, hubs, doctoral training centres, and events companies that are building the UK into a world-leading AI community.

ENGAGED REGULATORS: UK’s AI entrepreneurship, talent, investment, and branded businesses are in close proximity with regulators, which increasingly are playing a pivotal and positive role to help promote dialogue and shape the AI industry (in discussion with firms) to become ethical and purposeful. Examples of institutions and strategies include the Centre for Data Ethics and Innovation (CDEI), the Office for AI, the All-Party Parliamentary Group on AI and the AI Strategy published this autumn, to name a few.

Overall, the Centre can see how AI entrepreneurship activity in the UK is located close to finance, marketing and regulatory bodies that are needed to grow it and the AI community.

View report (90 pages) and analytics here: https://network.biginnovationcentre.com/press-launch-ai-industry

RSVP to online press Launch here [15 December 13:15]