Safeture has announced its latest financial results, with sales up 25% from 11.1 MSEK (€900k) in 2023 to 13.9 MSEK (€1.19m) this year. Net revenue for the company amounted to 27.5 MSEK (€2.36m), up 27% on last year. CEO Magnus Hultman commented that the results hit below financial targets this year “but were in line with our indication in our Q1 report”.

Safeture results were just shy of a positive one in the second quarter with an operational result (EBIT) @ -152 KSEK. The quarterly churn was back at low numbers (0,8 %), sales were short on target (25%) and the gross margin was spot on target (80%); this is in line with reaching our financial goals in the near future, the company said.

Hultman said that partners are its driver of growth, accompanied also by additional upsell on the installed base, which significantly contributes to the total revenue. Another growth driver was the company’s continued development and expansion of its recent partnership with a French insurance company. “Here we see a great potential to catch”, the CEO said.

He added: “For the past quarter, our largest partners have been busy working with existing clients, thereby adding fewer new logos. On the other hand, we see our partner development work taking effect and relatively new partners starting to add clients all over the world, from Europe to Australia.

“Partner development has been a key initiative for us during the past year and is important for Safeture to scale. This also underlines our two-fold growth formula; To be able to get introduced to existing clients of the partners as well as to win new ones in direct deals or RFPs.”

Balancing around profitability

Now, Safeture says that its focus will be on balancing around profitability, with several factors which can potentially turn it either way at any given quarter. One example is currency exchange fluctuations, given our large international exposure with approximately 93% of its revenue in foreign currencies, the company said.

Financial transactions in foreign currencies are reported at the exchange rate on the specific transaction date. Additionally, on the day of the fiscal quarterly closing, all outstanding receivables are revalued with the closing rate of that specific day. “This means we can receive rather substantial currency revaluation effects on the last closing date,” Hultman continued, “which are difficult to predict. Another example is personnel cost fluctuations driven by customary vacation periods where costs are typically low in Q3 but rising again in Q4. To sum up, we will stick to our target of sustainable profitability at around 65 MSEK going forward”.

Safeture’s licenses are sold through a SaaS business model, meaning its customers are contracted to pay a license fee yearly in advance. This model, in combination with a high operational focus on cash flow, is a great strength in our company, it was said in a statement. During the first six months, the risk management SaaS company has managed to increase the cash with more than 2 MSEK, to be compared with -6,6 MSEK during the equivalent timespan previous year.

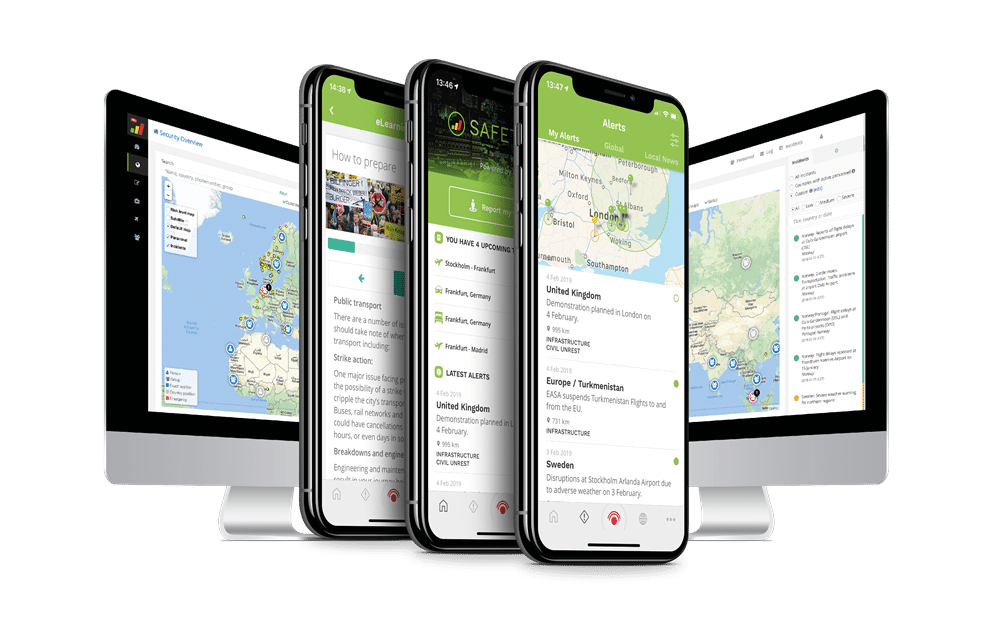

Building world-class technology, supporting clients globally

According to Safeture, it is the thought leader in people risk management, and its goal is to maintain and develop that position. The brand will continue to invest in its platform, especially since seeing growth opportunities in the market for risk management, which is riding a global trend.

It is time for summer, and there are plenty of high-risk events taking place, including the European championship in football and the upcoming Olympics in Paris starting July 26th. Safeture will be safeguarding people both before the event with our provision of valuable pre-event information and on-site with our technology and partners standing by.

Finishing off his CEO comment, Hultman added: “In our 15th year of working in this space, Safeture is helping people stay safe with an ever-expanding offer covering more organisations and users than ever.

“Lastly, I also take the opportunity to welcome our new board member, Thomas Wandahl, who was elected at our recent Annual General Meeting. Welcome Thomas Wandahl. Long career in the service and Telco industry and on the nomination committee’s radar due to his former role as Managing Director of Falck Global Assistance. Thomas will be contributing with additional insights in how our current and future partners think and operate.”

Results (Classics)

First six months (2024-01-01 to 2024-06-30)

Net revenue amounted to 27 525 (€2.36m) (21 744) KSEK (€1.87m) (+27%).

EBIT amounted to -571 (-4 086) KSEK.

Loss per share before dilution amounted to -0,01 (-0,10) SEK.

Loss per share after dilution amounted to -0,01 (-0,10) SEK.

Second quarter (2024-04-01 to 2024-06-30)

Annual recurring revenue (ARR) at the end of Q2 2024 reached 57 001 (48 623) KSEK, a year-on-year increase of +17%.

Recurring revenue increased by +25% to 13 727 (€1.12m) (11 011) (€900k) MSEK, which represents 99% (99%) of the quarterly revenue.

Churn for the quarter was 0,8%.

Net revenue retention (NRR) was 103%.

SaaS traction

Second quarter (2024-04-01 to 2024-06-30)

Net revenue amounted to 13 898 (€1.19m) (11 075) (€900k) KSEK (+25%).

EBIT amounted to -152 (-1 597) KSEK.

Loss per share before dilution amounted to 0,00 (-0,04) SEK.

Loss per share after dilution amounted to 0,00 (-0,04) SEK.

For for the full results, click here

For more Safeture news, click here